Three principles that should underpin the Budget

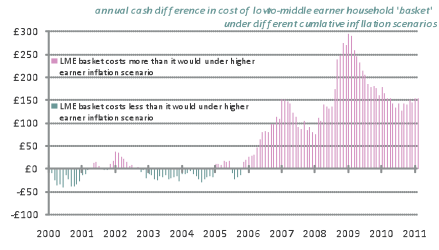

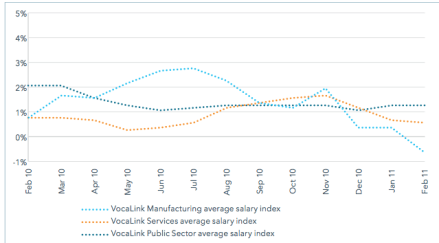

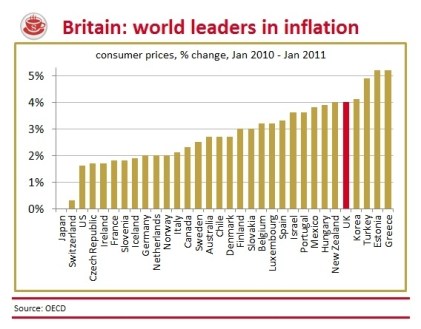

As I see it, there should be three simple principles underpinning George Osborne’s Budget tomorrow. Let’s take them one by one: 1) Variations in household wealth mean that policies aimed at affecting the wider economy will often have unpredictable political effects. Economists have a tendency to imply that changes in GDP affect everyone uniformly, but this isn’t the case. What’s more, journalists are quick to highlight extreme case studies that make good stories, but they can misrepresent the actual picture. Policy will do a lot to influence the economic climate, but the local economic weather will be more relevant to taxpayers. At the same time, the recovery can’t be managed