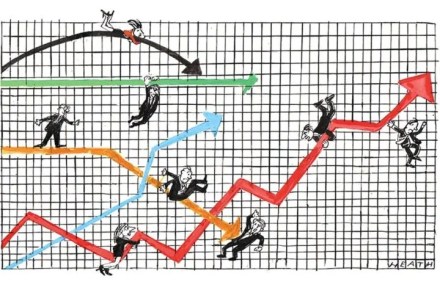

How much should we fear the return of the ‘bond vigilantes’?

BlackRock’s UK chief investment strategist, Vivek Paul, has warned this week that pre-election promises of large tax cuts or spending increases could unsettle the bond markets again. There are clear echoes here of the turmoil that followed the Liz Truss and Kwasi Kwarteng mini-Budget back in 2022. How worried should we be? These warnings should