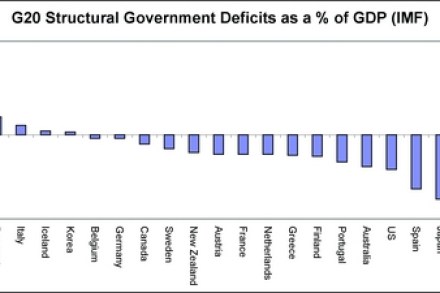

The corona stimulus shows we’ve learned the lessons of the crash

The Bank of England hasn’t wasted time getting in front of the coronavirus, and its actions this morning show how far things have moved from the days of Mervyn King. Perhaps more interesting than the interest rate cut is the Bank’s moves to quickly free up the best part of £200bn of lending capacity for