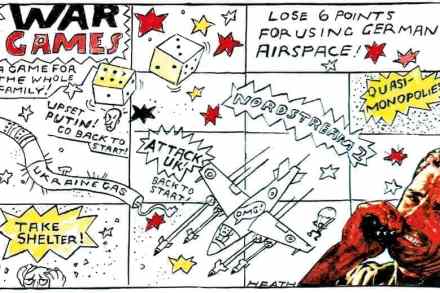

Andrew Bailey is floundering in the face of soaring inflation

Prices are rising at the fastest pace for 40 years. Real wages are falling rapidly. The cost of servicing the government’s vast debts is escalating, and companies are struggling to keep up with the rising price of raw materials. Still, not to worry. Fortunately, a quarter of a century ago Gordon Brown wisely decided to