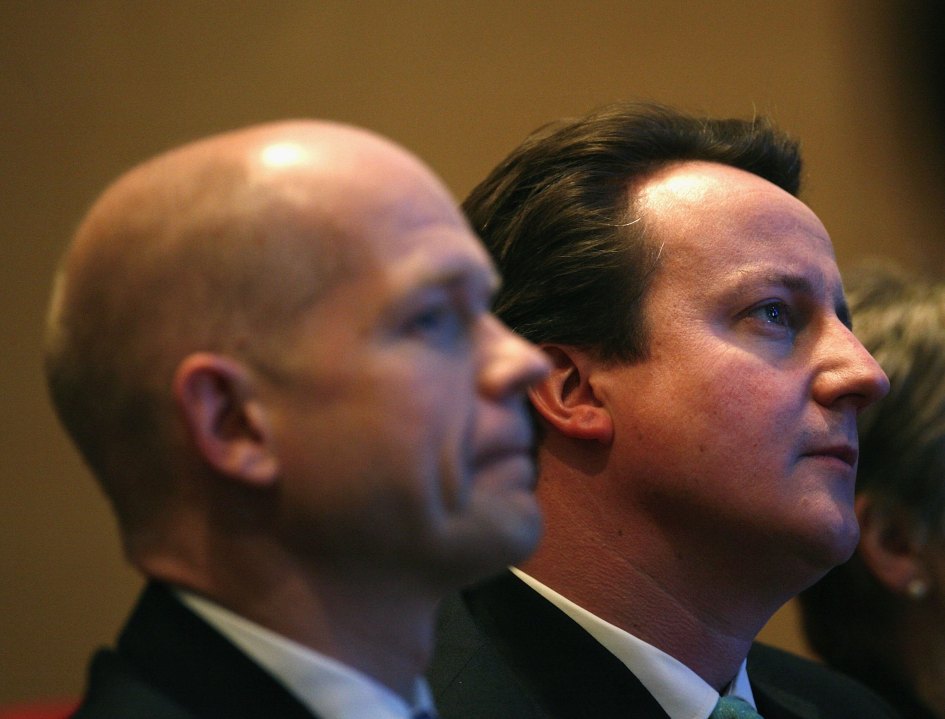

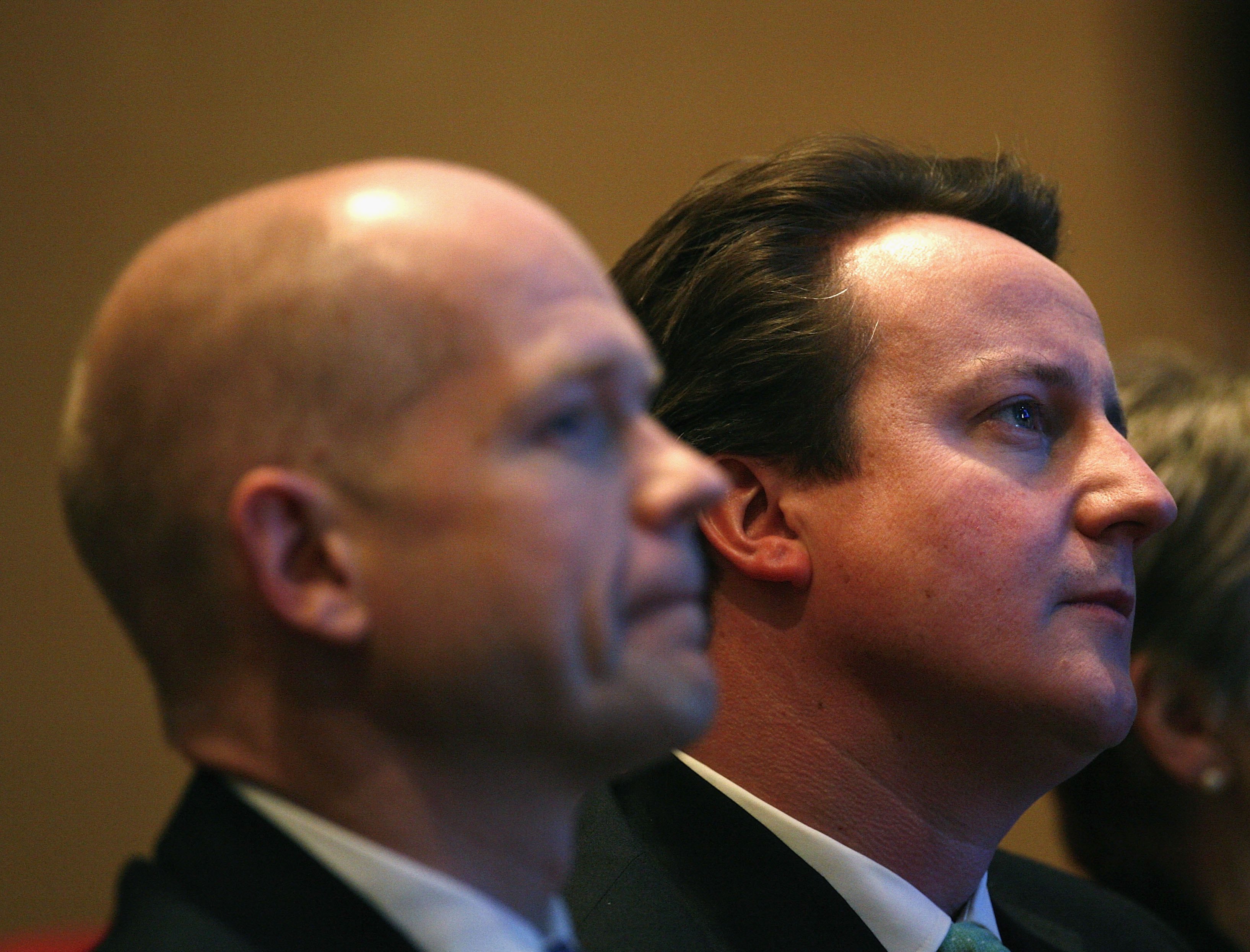

Euroscepticism is David Cameron and Gene Hunt’s sole shared attribute. But, bequeathed a poisoned chalice at home, the EU is not a future Tory government’s immediate priority. Set-piece battles over rebates, defence procurement and the CAP can be avoided for a time, but skirmishes will be a regular occurrence. And some of these will be bloodbaths.

Euroscepticism is David Cameron and Gene Hunt’s sole shared attribute. But, bequeathed a poisoned chalice at home, the EU is not a future Tory government’s immediate priority. Set-piece battles over rebates, defence procurement and the CAP can be avoided for a time, but skirmishes will be a regular occurrence. And some of these will be bloodbaths.

The first test comes in June, when EU finance ministers will consider hedge fund and private-equity firm regulation. There is no more contentious a topic. Recent European regulatory initiatives have impeded British financial services to the extent that even Brown and Miliband have taken note. It may be tempting to perceive a grand conspiracy against Britain, but the more likely explanation is that there is a profound disagreement over using tax as a regulation mechanism.

True to history, British interests are outnumbered: interventionism is in vogue. A fortnight ago, the European parliament voted in principle for a Tobin tax. The victory was total – only the Tories’ ECR group and a handful of sane rebels opposed it. Asset management is the next target, and 80 percent of firms are based in London. The Luxemburg Principle – a convention designed to protect ‘vital national interests’ with an unofficial veto – should apply. But you cannot trust in convention amid prevailing European opinion.

Europe is treacherous ground and it pays to fight sparingly. In an excellent article, The Economist argues that discretion is the better part of valour, and, generally, I agree. There are no garlands for the victor of the truffle quota ; they crown obdurate governments that preserved ‘vital national interests’.

Comments