Get ready for more Quantitative Easing. This week, Reuters found that economists think there’s a 40 per cent chance the Bank of England’s Monetary Policy Committee (MPC) will announce another round when they meet on Thursday. And even if they hold off now, it’s unlikely to be for long.

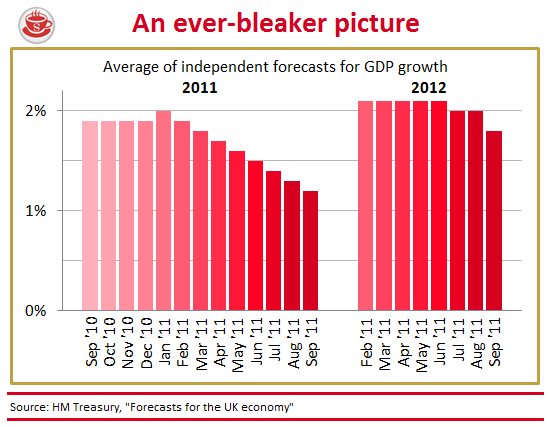

Weak growth and the worsening outlook for the economy seem to have changed minds. The Treasury has surveyed growth predictions from independent forecasters. Back in January, the average prediction was for 2 per cent growth in 2011. It has since fallen steadily to just 1.2 per cent. Similarly, expectations for 2012 have also been downgraded, from the 2.1 per cent growth expected in June to 1.8 per cent now.

Other options would be available to stimulate growth in normal circumstances: chiefly expansionary fiscal policy (ie. increasing government spending or cutting tax revenues) or lowering central bank interest rates. But both of these are out of the question now. The government is determined to meet its fiscal rule (a cyclically adjusted current surplus in 2015-16), in order to avoid both political embarrassment and a potential credit ratings downgrade. And the MPC already brought the base interest rate down to rock bottom (0.5 per cent) in March 2009, and has kept it there ever since.

So, how much QE is needed? The previous round – from March 2009 to January 2010 – saw the Bank of England buy £198 billion worth of gilts. In their latest Quarterly Bulletin, the Bank estimates that it boosted Real GDP by 1.5 to 2 per cent. According to Citi’s Michael Saunders, this implies that £140 billion to 190 billion is required this time round to produce the extra 1.4 per cent of GDP growth needed to make up the shortfall forecast by the IMF. Saunders expects the total QE to be much bigger (at around £300 billion) because he predicts a larger GDP shortfall.

The danger of another round of Quantitative Easing is the effect it might have on inflation. The Bank of England estimates that the last round added 0.75 to 1.5 percentage points to CPI inflation. This was considered a good thing in 2009, when inflation dropped as low as 1.1 per cent. But CPI inflation now stands at 4.5 per cent, and the MPC admit it will probably hit 5 per cent soon. The minutes of the last MPC meeting record:

“The Committee’s view remained that the most likely near-term path for inflation was for a temporary rise to a peak of over 5% before the year end, in part reflecting announced

utility price changes. Inflation was then expected to fall back sharply in the first part of 2012, with the impact of the change in VAT dropping out of the twelve-month comparison contributing

around 1 percentage point to the fall.”

While Citi agree that there will be a sharp fall early next year, they predict that it will hold at around 3 per cent for most of 2012, and their longer-term forecast has it at or above 2.5 per

cent until June 2015.

If a new round of QE is added to this, the squeeze on living standards may well last for several years.

This is the first in a series of Coffee House crib sheets on various issues that are likely to blow up in politics or economics. Do let us know if you find them useful.

Comments