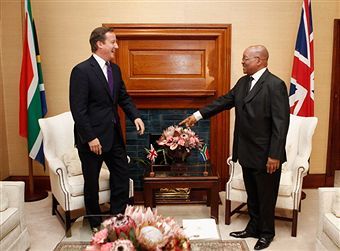

As James has said, David Cameron is in South Africa for the start of a two day trip to Africa to promote free

trade and foster trade links. He projects his vision in an article for South African Business Day:

As James has said, David Cameron is in South Africa for the start of a two day trip to Africa to promote free

trade and foster trade links. He projects his vision in an article for South African Business Day:

‘In the past, there were marches in the west to drop the debt. There were concerts to increase aid. And it was right that the world responded. But they have never once had a march or a concert to call for what will in the long term save far more lives and do far more good — an African free trade area. The key to Africa’s progress is not just aid. It is time for some fresh thinking. Consider these facts. An African free trade area could increase GDP across the continent by an estimated $62bn a year. That’s $20bn more than the world gives sub-Saharan Africa in aid. Backed by investment in people and infrastructure, sound government and effective tax systems, imagine what this would mean: businesses growing, new jobs on offer, families on the up, living standards transformed.’

To that end, Britain is supporting the Africa Free Trade Initiative to reduce internal tariffs, challenge bureaucratic (shall we say) idiosyncrasy, and improve transport communications, all of which is designed to boost British trade and improve our diplomatic relations in Africa. This fits neatly into the government’s view that international prosperity will promote international security, the meme that guides the massive increase in the aid budget. DfID and the Foreign Office are striving to tackle political corruption in Africa and other impediments to commerce, mainly by ensuring that aid bypasses toxic political organisations and figures. But, it must be stressed, this is a nascent process.

Cameron sounds confident, but the competition is stiff. Chinese investment in Africa is notoriously extensive – estimated at $33 billion between 2002 and 2007 alone. And many other emerging Asian economies are joining the 21st Century scramble for Africa: the IMF projects substantial investment from the Far East in the next decade. It’s also worth noting that Taiwan is seeking bi-lateral free trade agreements with individual African states, which may prove more workable than building a free trade block. Equally, Taiwan may be a more attractive proposition than Old World powers like Britian: following the recent rapprochement between Beijing and Taipei, Taiwan is modelling itself as the secret door to access China’s vast and expanding internal markets. Whether it succeeds in that regard remains to be seen.

Also, African countries are trying to entice private sector firms to fund infrastructure projects that were conceived before the global financial crisis struck. Multinationals look ready to bite: groups like Fidelity are now preparing new funds to develop African economies for profit. All in all, UK PLC has its work cut out.

Comments