The Spectator brings you the latest insight, news and research from the front line. Sign up here to receive this briefing daily by email, and stay abreast of developments both at home and abroad.

News and analysis

- A leaked Treasury report warns the UK could face a 1970s-style ‘sovereign debt crisis’ unless the Chancellor introduces new taxes, freezes public sector wages and ends the pensions triple lock. Details below.

- The UK economy contracted by 2% in Q1, the biggest drop since the financial crash.

- Self-employed workers can now apply for an income support grant of up to £7,500.

- Covid-19 hospital admissions are falling more slowly in the north of England than the rest of the country.

- The true number of care home deaths could be as high as 22,000, double the official figure, according to research from the LSE.

- The National Education Union has told teachers not to ‘engage’ with the government’s plans to reopen schools. The warning came after concerns over the government’s PPE advice to staff.

- Activity levels began to rebound at the start of May even before the partial relaxation of the lockdown, according to research by UCL.

- A transport union has warned that train drivers will refuse to run services if they feel unsafe.

‘Are you sure there’s no way I can work from work?’

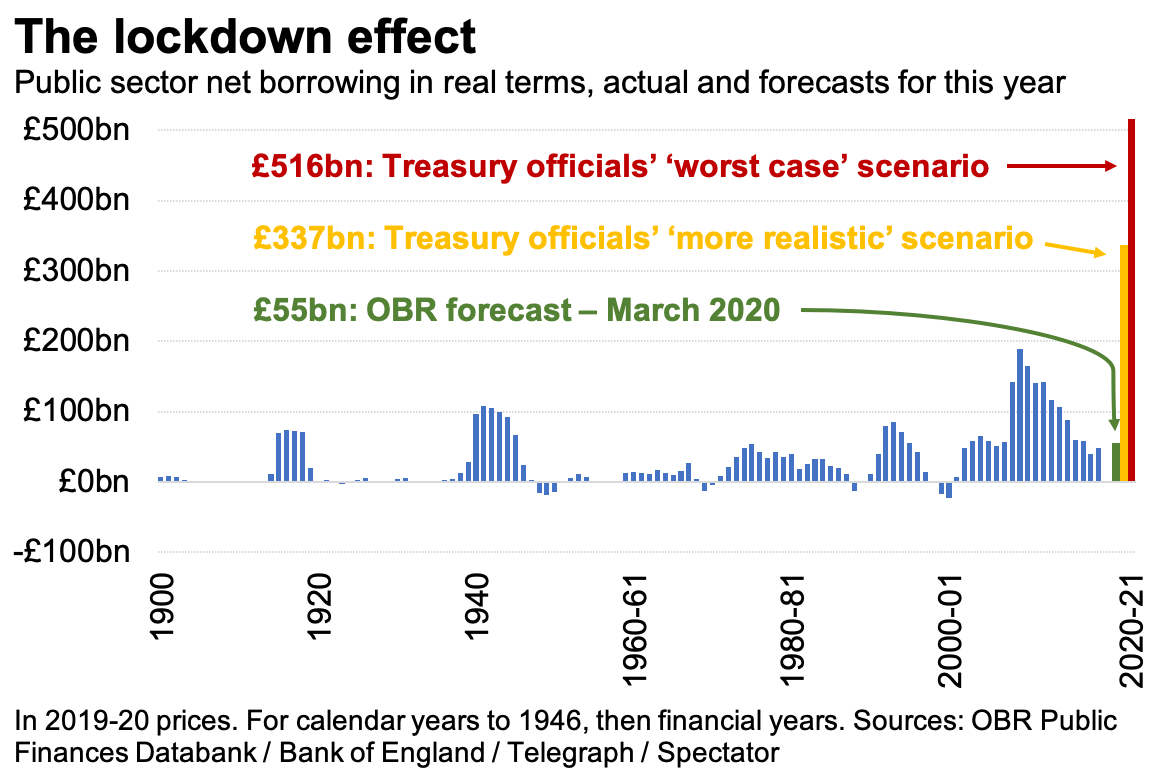

A £516 billion deficit?

A leaked Treasury report the Daily Telegraph today reveals hat its worst-case scenario is a deficit of £516 billion – almost ten times that expected in the March budget and treble that seen after the 2007/8 crash. That such a report was written in the first place suggests concern in HM Treasury that No. 10 has been slow to realise the economic consequences of lockdown and has judged measures only by modelling progress of the virus. The Treasury, it seems, has engaged in some modelling of its own. Its memo is quoted as saying:

In a worst-case scenario, this could lead to a liquidity crisis and, ultimately, a sovereign debt crisis. A comparable UK scenario would be market conditions in 1976 ahead of the IMF loan when high and volatile inflation led to a loss of macro strategy credibility and a reluctance to hold UK debt.

Britain’s Q1 GDP data, released this morning, is dire but captures just a fraction of the lockdown effect. The 2 per cent quarter-on-quarter decline is far less than the 5 per cent reported for France, Italy and Spain – all harder hit because they locked down slightly earlier.

The leaked Treasury document suggests massive tax-raising measures, but this exaggerates the options open to the government. In truth, the UK tax take stood near a 35-year high before the virus and it’s not clear that it’s possible to squeeze significantly more tax out of the economy without choking it. The high rates of tax in the 1970s led to far less revenue: the best-paid 1 per cent then contributed 11 per cent of all tax paid. Now, they account for 29 per cent. The 50p rate, when introduced in the UK after the 2009 crash, led to less income tax collected. Above a certain level, higher rates mean lower yields. Attempts to impose high rates would anyway serve as an advance resignation letter from a Tory government elected on a pledge to avoid them.

Everything now hangs on the markets lending staggering sums to governments at rock-bottom rates. Their willingness to do so until now has, arguably, led to lockdown economics: the idea that it’s now possible for government to borrow billions, then hand the cash to furloughed workers, without any financial penalty. This has, so far, been the experience. Markets have played along. The UK’s economic viability may depend on their continuing to do so.

Dole queues in the time of coronavirus

In words

The higher it goes above 1 – like 1.2 or 1.3, and over a longer period of time, it would create a situation where we would pay very close attention and think about measures how to countersteer that.

– Lars Schaade of the Robert Koch Institute on why Germany does not share the UK worry about the R-number rising above 1.

It is unlikely that big, lavish international holidays are going to be possible for this summer. I just think that’s a reality of life.

– Matt Hancock on This Morning.

We will have a summer tourist season.

– Paolo Gentiloni, the EU’s economic commissioner.

Iceland study: no evidence of children passing virus to adults

In Iceland, a company called deCODE Genetics has analysed the results of coronavirus tests on 36,500 people, around a tenth of the population. The tests identified 1,801 cases of the disease – and ten deaths. Each case was carefully tracked, with mutations allowing researchers to work out who caught it from whom. In not a single case could the researchers find evidence of a child passing the disease to their parents. The study reinforces the results of a review of evidence last week by the Royal College of Paediatrics and Child Health, which said it couldn’t find a single documented case of a child under ten passing Covid-19 to an adult. In one case a nine-year-old boy returning from a skiing holiday in the Alps was found to be infected with Sars-CoV-2, the virus which causes Covid-19, as well as influenza and the common cold. He didn’t pass Sars-CoV-2 to anyone, in spite of coming into contact with 170 children. He did pass the flu and cold to his siblings – but not Sars-CoV-2. This ought to be pretty strong evidence that opening primary schools is safe, and should be among the first moves taken to exit from lockdown.

Read more from Ross Clark on Coffee House.

Global news

- Brazil has become the sixth worst-hit country for Covid-19 deaths (after the US, UK, Italy, France and Spain).

- Russia has now surpassed the UK and Spain’s total number of confirmed infections after suffering 10,000 new cases per day for the past week.

- Singapore will test all 323,000 foreign workers in the country.

- The border between Germany and Austria will reopen on 15 June.

- Spain’s oldest woman has beaten coronavirus aged 113.

- A German ministerial adviser has been sacked after releasing a rogue report arguing that lockdown is causing ‘a large number of avoidable deaths’.

- New York’s Broadway theatres will remain closed until at least September.

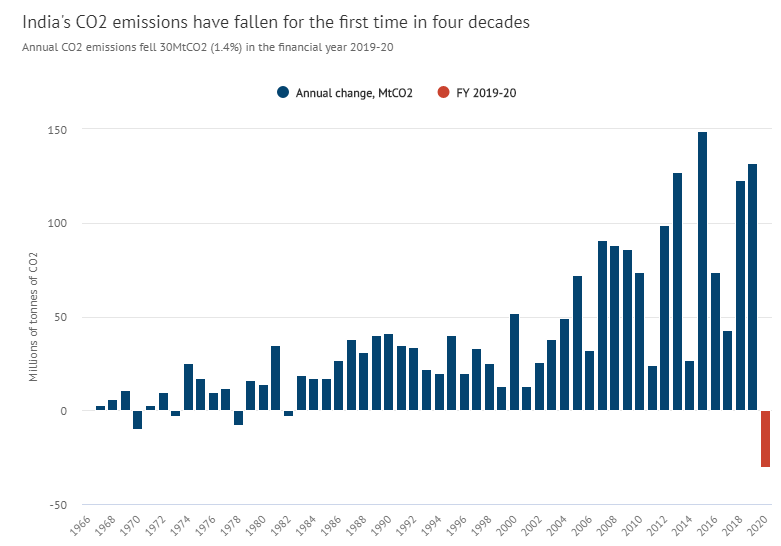

Datawatch: India’s CO2 emissions plummet

Our latest podcast

Research: Smoking and Covid-19

Evidence so far has indicated that smokers could be more resilient to Covid-19 than non-smokers. But new analysis from researchers at UC San Francisco finds that people who smoke have their ‘risk of disease progression… significantly increased’. The meta-analysis includes 19 peer-reviewed studies into the link between smoking and Covid-19, including 11,590 Covid-19-positive patients. Out of those patients, ‘2,133 (18.4%) experienced disease progression and 731 (6.3%) with a history of smoking’. It finds ‘a total of 218 patients with a history of smoking (29.8%) experienced disease progression, compared with 17.6% of non-smoking patients’, suggesting that smoking may nearly double one’s chance of suffering seriously from Covid-19 symptoms.

Coronomics

- Donald Trump has ordered federal pension funds to stop investing in Chinese stocks.

- Tesla’s factory in California has been allowed to stay open after CEO Elon Musk defied county rules to reopen yesterday.

- People in the UK can now move home as estate agents and removal firms reopen for business.

- Travel firm Tui has said that it will cut up to 8,000 jobs as a result of the pandemic.

- One of the UK’s largest commercial landlords has warned that rents could fall by as much as 75% due to retailer defaults.

- Twitter has decided to allow employees to work from home permanently.

- India’s CO2 emissions have fallen for the first time since 1982. Meanwhile, the country announced a Covid-19 rescue package worth £216 billion.

- Boeing failed to sell a single plane in April. The company also made no sales in March.

- Consumer spending dropped by over a third in April, according to data from Barclaycard, with spending on non-essentials falling by half.

- The world’s largest shipping company has warned that the volume of goods it moves will fall by 25% this quarter.

More from The Spectator

Can we trust Covid modelling? More evidence from Sweden – Johan Norberg

Ten reasons to end the lockdown now – Dr John Lee

This study from Iceland suggests reopening schools is safe – Ross Clark

Boris’s Whitehall overhaul has just become even more ambitious – James Forsyth

Let’s use this crisis to tackle Britain’s woeful skills shortage – David Goodhart

Self-isolation tips from Spectator Life

Six superhero films with a highbrow edge – Alexander Larman

Home school club: why did the Apollo 11 flag ‘flap’ on the moon? – Mark Mason

Pecan pie recipe – The Vintage Chef Olivia Potts

Comments