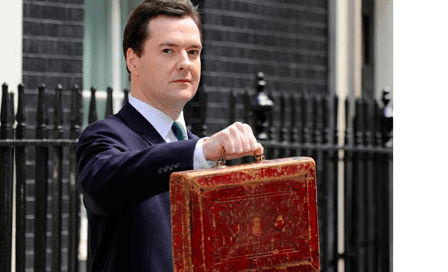

George Osborne has today said that he’ll allow people to sell their annuities for cash, and will consult on how best to establish a market for second-hand annuities. This move will be popular with many of the five million or more who have been forced to buy these annuities in recent years.

Here’s what you need to know.

1. Annuities have become worse value but people still forced to buy as there was no other way for many to take money out of their pension funds. The rules required anyone who wanted to withdraw some cash from their pension savings to ‘secure an income’ and if they did not have very large amounts in their fund, they had no other option – they had to buy an annuity. When interest rates crashed, so did the annuity payout. This has hit pensioners hard.

2. The richest, with largest pension funds, could avoid annuities: Those with large funds did not have to annuitise, but the vast majority had no choice. And, until now, once they had bought the standard type of annuity, they had no chance to change it, they were stuck with it for life. (Selling the annuity income might have been theoretically possible, but would face a tax charge of between 55% and 70%, so this was not a realistic option).

3. Osborne says he will now consult on second-hand annuity market: Of course, the Chancellor’s last Budget swept away those old rules, but those who had already bought an annuity seemed stuck. Not now though. A consultation will start on 18th March on how best to establish a market for second hand annuities.

Those who were forced to buy an annuity under the old rules but never wanted to have been writing to their MPs to complain about the unfairness of being forced to buy an irreversible product, when they would not need to do so under the new rules. There are many who would much prefer the lump sum. They may have other pension income, they may have large debts, or a mortgage or may need money to pay for health or care needs or other urgent spending.

Also, if someone has become very ill and is unlikely to live long, or needs to pay for care, they might find a lump sum more useful, even if it is much less than their original pension.

From April 2016 people should be able to sell their annuity for a lump sum or drawdown: Osborne intends to allow people to sell their annuities to the highest bidder, and take the cash either as a lump sum, taxable as income, or put into a pension drawdown product and any withdrawals would then be taxed as income. Most people will probably decide to hang onto their annuity, but many may have good reasons to want to consider flogging it. They will not be forced to, it will be up to them, but at least they will have the choice to do so, whereas until now their fund was gone for ever.

Nobody will have to sell their annuity, it will be their choice. Unlike when they purchased it, they will not be forced to cash it in and many will not wish to. However, giving them the option is only fair. Many of those who bought annuities understandably feel aggrieved that their money has gone to an insurer in exchange for a relatively low income with no inflation protection, whereas future pension savers can enjoy full freedom to choose what is best for themselves. This is a popular and sensible decision which will be warmly welcomed by many.

Comments