Remember when Alistair Darling said that we faced the worst financial crisis for sixty years? Now Mervyn King has trumped that piece of doom-mongery by telling Channel 4 last night that “This is undoubtedly the biggest financial crisis the world economy has ever faced” (see video above, three minutes in). The Governor of the Bank of England saying that this is the worst crisis ever? On the day that he rushed another £75 billion into the economy? As mood music goes, it is a particularly dreadful symphony.

It is also the sort of situation that Ed Balls will relish, especially with the Pre-Budget Report approaching. And it is true: George Osborne is in a tight spot, both politically and economically. Economic forecasts will tumble; deficit reduction will veer off course; and calls for a growth agenda will intensify, even aside from what the government announces this autumn. Indeed, the shadow chancellor covered much of this ground in his comments yesterday.

But the politics do not all go Balls’s way. Far from it. There is, after all, something very different about about a bust — should one occur — that comes one year into a government, and

one that comes ten years into a government. A poll in May (I cannot find a more recent version) suggested that

“If the British economy gets worse in the next 12 months,” Labour would take as much blame as both the banks and the state of the global economy, and twice as much as the Tories. Stir in

Ed Miliband’s aversion to policy, and it is far from clear that Labour will capitalise from these economic horrors.

And as for the economics, two questions hover blackly over yesterday’s events. The first is whether a round of QE that amounts to 5 per cent of GDP will have a significant effect on economic

growth. And, as Clarissa explained in her post yesterday, the evidence from QE1 certainly casts doubts on

that.

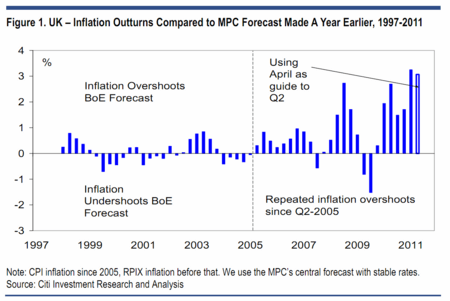

And the second question is how this will affect inflation. The Bank’s official position is that inflation isn’t really the problem, especially not in future — and that was supported by Osborne on the Today Programme this morning. Which makes this a good time to pull out what, in a perverse sort of way, is one of my favourite graphs of the crisis. It’s from Citi, and shows just how often, and how much, the Bank has underestimated inflation in recent times:

Read Coffee House’s briefing on QE here.

Comments