This time it was surely all over. As inflation started to rise towards a 40-year high, as central banks started raising interest rates for the first time in more than a decade, and as the monetary printing presses finally stopped running, the crypto-currencies crashed.

What a crash it was. Bitcoin, the best-known crypto, fell all the way from $61,000 last November to less than $19,000 in June, a spectacular drop of more than two thirds. Ethereum, Solana and other, frailer ‘coins’ – as well as the even flimsier digital collectors’ items known as NFTs – all tanked. This appeared finally to confirm what the doubters had said all along. Cryptocurrencies were nothing more than the latest in a long line of speculative manias: a 21st-century version of the Dutch Tulip Bubble of the 1630s. It was bound to pop sooner or later, and it had.

Hold on, though. In fact, something more interesting is happening. The cryptos may have collapsed, but now they are steadily coming back. Since the middle of June, Bitcoin has clawed its way to almost $25,000. Ethereum has doubled in value during the last month, rising from slightly over $900 to $1,800. Solana has gone from $30 to $45. The list goes on.

None of the cryptocurrencies has yet got close to recovering their peaks, and this may turn into what the traders call a ‘dead-cat bounce’. But the events of the past few weeks have perhaps started to look like a durable recovery, one that should run for several months.

This is what makes cryptocurrency different from typical investment mania. After the crash of the frenzied tulip market, the bulbs never came back (except of course in gardens). After the popping of the South Sea Bubble in 1720, the South Sea Company staggered on until 1853 but it never reached its former heights. Radio stocks, part of the huge run-up in the 1920s bull markets, didn’t return to their old prices after the Great Depression. The Japanese market, the biggest post-war bubble, is still a long way short of its 1989 peak. Once a real bubble bursts, it’s over, and everyone moves on.

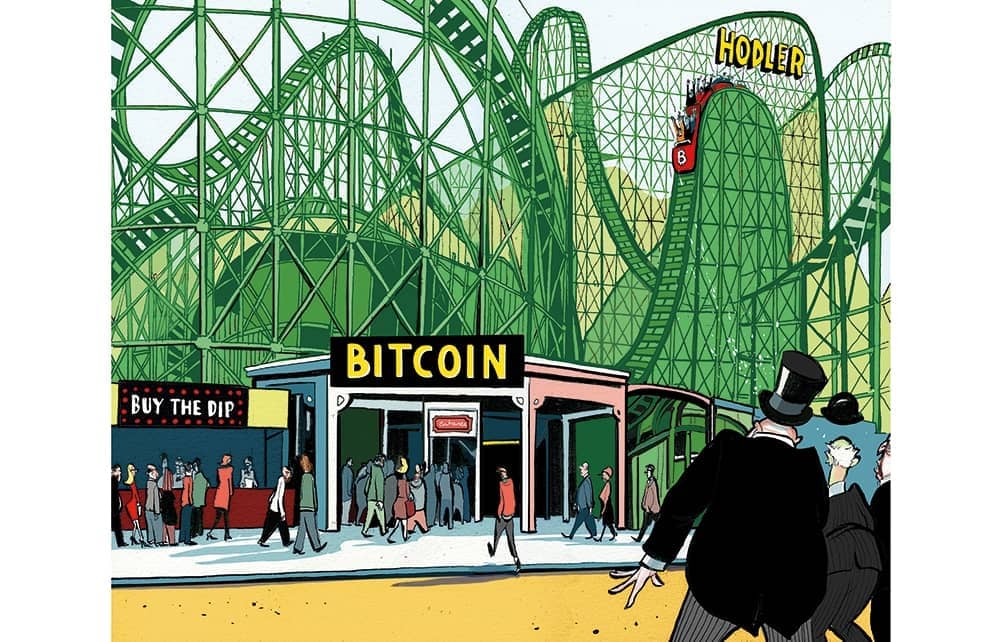

Cryptos are not like that. They remain an almost insanely volatile investment. If you bought anywhere near the top of the market, this has certainly been a punishing year to hold any of the main cryptocurrencies. Even the jovially named Dogecoin, originally set up to satirise the whole crazy boom, fell from $0.33 last November to just $0.06, a fall of more than 80 per cent.

Speculators piled into cryptos during lockdown, partly because there wasn’t much else to do

The stock market may have taken a pummelling over that period, along with most other assets. But it was the cryptos that suffered the worst carnage, burning a generation of investors who had jumped on the bandwagon as it gathered momentum.

So it was easy – too easy perhaps – to make a case that crypto was finished. The currencies never had any real substance, said the experts. They were the froth of the financial bubble, generated by a decade of ultra-cheap money during which central banks printed cash on an unprecedented scale. Speculators piled into them during lockdown, partly because there wasn’t much else to do. But as the easy-money era came to a crunching end, they were exposed as worthless.

Worse still, they had been sold as a protection against inflation: a form of digital gold that, because the supply is strictly limited, would hold their value even as governments debauched their currencies and drowned in debt. Yet once inflation did arrive, hitting 9 per cent or more in most major economies, the cryptos promptly collapsed. They weren’t a store of a value after all.

And none of them, not even Bitcoin, is seriously used by the masses as currencies either. So what was the point of it all? Nobody knew – until the latest rally began, and suddenly everybody has begun to believe that crypto is ‘the future of money’ again.

Bitcoin has now been through four major crashes, and several minor ones. But every time it has recovered. In 2011, it rose from $2 to $32 in frenzied trading, then fell back to a single cent. In April 2013, it soared again, rising to $260, before crashing back down to $50. In 2017, it went on an epic bull run, going all the way up to $20,000 before collapsing again, settling below $12,000, and remaining in the doldrums for most of 2018.

Then came the epic charge of 2020 to 2021. Serious funds started directing serious money into cryptocurrencies and even NFTs. Elon Musk, the world’s richest man, put huge chunks of his assets into cryptos.

Collapse seemed inevitable and it was. But that just seems to be what cryptos do. They boom, then bust, and then the whole cycle starts all over again. They may be heading south once more by the time you read this article. But here is the key part: each time around, the peak has always ended up higher and the floor tends to as well.

In that respect, then, cryptocurrencies are starting to look a lot more like a normal financial asset, whether equities, gold, property or the dollar. On the other hand, it’s also possible that we’ve never seen anything quite like them.

Comments