Already a subscriber? Log in

Election special offer

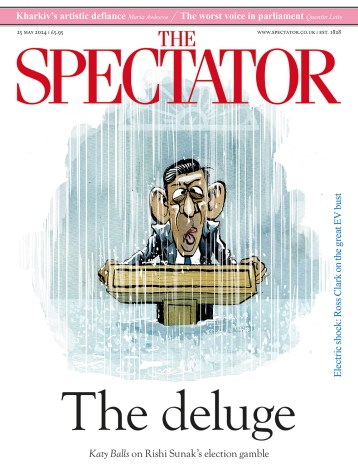

The stage is set. Grab a front-row seat with The Spectator. Subscribe and get 3 months for just £3 – plus a free election mug.

- Weekly delivery of the magazine

- Unlimited access to our website and app

- Spectator newsletters and podcasts

- Our online archive, going back to 1828

Comments

Want to join the debate?

Only subscribers can comment. Sign up and – in the run-up to the election – you’ll get the next 12 weeks for just £12.

CLAIM OFFER 12 weeks for £12Already a subscriber? Log in