The Chancellor of the Exchequer found time this week to edit her own page on the social media site LinkedIn. She had, it appeared, fallen into error by saying that she had worked as an economist for the Bank of Scotland. Her role had in fact been humbler.

No one should be criticised for seeking to correct a mistake. There is no fault in acknowledging that your claims to economic authority were exaggerated, and no shame in embracing humility. Which is why Rachel Reeves should apologise again – without further delay – to Britain’s farmers. For the grotesque, unjust and vindictive tax assault she has launched on the nation’s food producers.

The government, by removing the Agricultural Property Relief (APR) exemption from inheritance tax on farms worth in excess of £1 million, has acted in bad faith, succumbed to faulty reasoning and undermined the most important industry in the country.

Rachel Reeves seems determined not to back down, mistaking stubbornness for strength

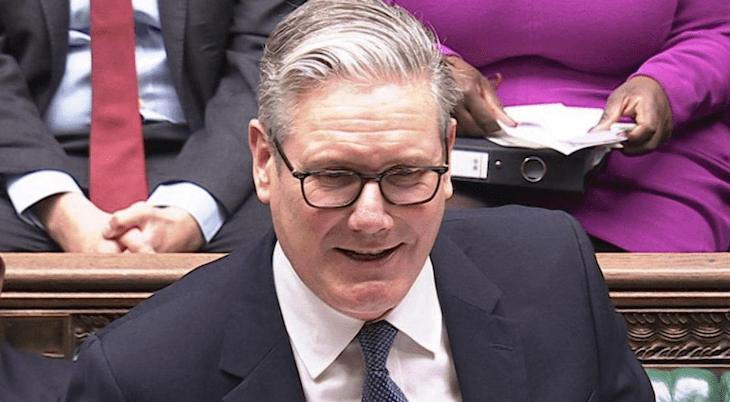

Labour has justified other tax raises with sinuous, Jesuitical casuistry – arguing, for example, that its promise not to increase national insurance applied only to employees (working people) and not employers (presumably all idle rentiers in their mind). But when it comes to the promises made to farmers there is no such ambiguity to exploit. In opposition, Labour said that they had no plans to abolish APR. Their spokesman gave solemn assurances to successive farmers’ union conferences. As indeed did Sir Keir Starmer, who told the National Farmers’ Union in no uncertain terms: ‘Losing a farm is not like losing any other business. It can’t come back. That’s why the lack of urgency from the [Conservative]… government, the lack of attention to detail, the lack of long-term planning, it’s not on.’

The lack of attention to detail, indeed. The Treasury were so convinced of the rightness of their tax raid that they failed to consult the Environment Department on the measure, informing the Secretary of State only the night before that the promises he made in opposition were now so much bio-waste. In the days that have followed it has become clear that the Environment Department’s assessment of the number of farms in scope is much larger than the Treasury’s estimate. As farmers have been at pains to point out since the Budget three weeks ago, you do not have to own much land nowadays to find yourself with assets worth in excess of £1 million. Attempts by Reeves to maintain that only a tiny number of farmers will be affected have inspired about as much confidence in her accountancy skills as we can have in her CV.

The Treasury have long had APR in their sights, and have always sought to rein in what they consider to be overgenerous treatment of farmers. Previous ministers have stoutly resisted, recognising that the food and drink sector is our biggest industry and that its success depends, crucially, on support for domestic food production. Indeed, the Labour manifesto proclaimed that ‘food security is national security’.

If the Environment Secretary had been properly consulted, no doubt he could have acquainted the Chancellor with the basic economic insight that making the position of farmers even more financially perilous hardly encourages investment in the machinery, tech and innovation that will strengthen food security. According to Defra, 30 per cent of farms made a loss in 2023/24, and a further 25 per cent made profits of less than £25,000. That many of them have assets of more than £1 million is not the full picture: farmland is a very low-yielding asset, even if you are farming it yourself.

Farmers facing penal taxation on their land when they pass it on to their families are incentivised to pre-empt the Exchequer and sell up now. There will be willing buyers in the (still happily subsidised) renewables sector only too keen to build solar farms where once there were real ones. And they will be jostling in the queue with the volume house builders whom the government have greenlit to build on the greenbelt.

There are still ways in which the Chancellor can mitigate the damage. She could retain an exemption for families who have been farming land for longer, say, than 20 years. She could up the threshold at which tax is levied to protect smaller farmers. She could keep the exemption on farmland but levy capital gains tax on the full value of land sales, so that it would only catch landowners who cashed in their assets.

But Reeves seems determined not to back down, mistaking stubbornness for strength and pigheadedness for principle. For the nation’s farmers, casting an envious eye at the public sector workers who have secured inflation-busting pay increases after flexing industrial muscle, the lesson seems to be that the government only moves when pleas turn to threats. That is an unhappy precedent to have set. A better one is there on LinkedIn – scrub out the error and move on, rather than continue to take people for fools.

Comments