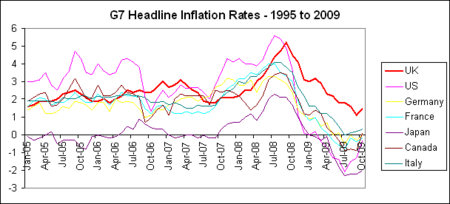

The UK inflation rate again “surprised” to the upside today, registering at 1.5%. As the above chart shows, the UK now has by some margin the highest inflation rate in G7. Were it not for the temporary VAT cut – which takes about 1% off the current CPI rate – the rate would be moving quickly above the Bank of England’s target of 2%. It would seem that the deflation threat, used as justification for the Bank of England deciding to finance the Government’s deficit this year through printing money, has not transpired. A severe recession and rise in unemployment has hit the economy, but this seems to be one where wages stagnate but the prices of what we consume continue to rise.

While the spin is that this rise is caused by temporary factors related to energy prices, the details tell a different story. As the above chart shows, two thirds of the components of the CPI index are running above the Bank of England’s 2% target rate. With airline duty rising sharply, train fares rocketing, petrol prices soaring, booze taxes rising by 9%, and a reversal of the VAT cut coming in January, there’s no lack of upward pressures to inflation. It is conceivable that the CPI rate could move well above the 3% trigger for the Bank of England Governor to write a letter explaining why printing a huge amount of money has led to the “surprise” of excess inflation in the New Year.

The big problem for most people is that there is very little chance of getting a salary hike to pay for this. Those not having the good fortune to be working in the public sector or for banks are likely to see a second year of pay freezes or cuts. Standards of living simply decline as people’s earnings are worth less.

The main culprit for this rise in inflation has been the need for Government to impose ever greater tax hikes on consumption to pay for the huge deficit, and the collapse in the Pound over the past two and a half years. The UK imports most of its consumption from the remainder of the EU; hence the 25% decline in the value of the Pound ultimately works its way towards higher prices. While a weaker currency helps exporters and domestic producers win market share, it takes time to rebuild the domestic production base which has been lost over the past 15 years. Furthermore, the zombie banking system is largely unable to support higher capital investment, slowing the ability of exporters and producers to respond to the weaker currency. The large number of stores closing due to financial and credit problems does nothing to reduce retail margins to offset import price rises.

It may have been much wiser for the MPC to have viewed the VAT cut as a temporary distortion downwards in the inflation rate, and focused more on the underlying rate of inflation which has not shown much sign of declining over the past year. This however would have had the rather inconvenient result of not allowing such a sense of deflationary emergency to provide the cover for the massive printing of new money. It is very telling that with the Federal Reserve in the US announcing the end of their experiment with Quantitative Easing, no other country is following the UK’s approach of printing money and huge deficits as the route to recovery. With wages stagnating due to high unemployment, the Bank’s policy of funding the Government through printing money risks amplifying the wealth and income shock being suffered by British households.

Comments