Should the 10p tax rate be brought back? Should the top rate be higher, or lower? Can the personal allowance be raised further? Is a mansion tax a good idea? Should the fuel duty rise be scrapped?

These are the questions that are rearing their heads again — as they do every six months or so, in the run up to a budget or autumn statement. The problem is that they are all considered — in so far as they’re considered at all — in isolation. We focus on one aspect of the tax system, fiddle with it a little, then move on to another.

And, as Institute for Fiscal Studies director Paul Johnson bemoaned this week,

‘the general quality of political and public debate is limited, allowing poor policy to be passed off as good all too easily, resulting in an unhelpful focus on specific parts of the tax system, and often making change politically difficult. Very specific elements of the system – notably rates of income tax – achieve totemic significance far beyond their true importance, while changes to other parts of the system are often given wholly inadequate attention.’

The result is, to put it mildly, a mess. We end up with the highest earners facing a marginal income tax rate of 50p, but those earning £100,000 to £116,210 facing a higher 60p rate (due to the withdrawal of the personal allowance). We end up paying 20 per cent VAT on a pasty that’s been kept warm, but none on one that’s just come out of the oven. We end up with someone in a house worth £20 million paying only twice as much council tax as someone in a house worth £200,000. We end up with separate allowances for income and capital gains, rewarding those who have both over those who rely on one or the other.

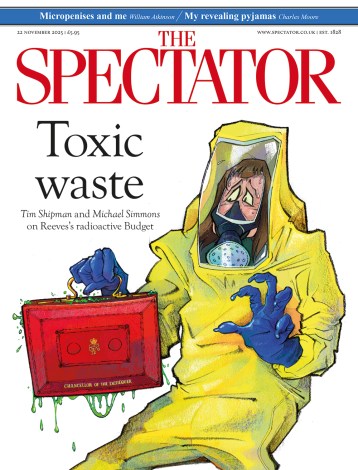

The leader in this week’s Spectator highlights the proliferation of new taxes in recent years — most of them introduced without much thought of how they would interact with the others — and the unintended consequences that can follow. On Tuesday, Isabel suggested that an overhaul of the tax system could do more to tackle tax avoidance than the tinkering going on at the moment.

In 2011, the IFS published the Mirrlees Review report, which contained recommendations for how the UK might move towards a ‘good’ tax system. They included merging income tax and National Insurance (something the government is, to its credit, considering), replacing council tax with a proportional tax on the current value of houses, scrapping stamp duty, replacing business rates with a land value tax, replacing fuel duty with a national congestion charge system, making interest on bank and building society accounts tax-free, and taxing capital gains above a ‘rate-of-return allowance’ at the same rate as other income. It also advocates ending zero- and reduced-rating for VAT — and calculates that this could pay for a package of reforms (including cutting the main income tax rates from 20p to 18p and from 40p to 38.5p) that would leave each household as well as off as it is now and cut the deficit by £3 billion.

These are the sorts of big, bold changes a truly reforming Chancellor would advocate. Of course, care would have to be taken, particularly around the transition process from current taxes to new ones. And, of course, there will always be a great deal of debate over whether certain taxes are fair or economically sensible. But even though we might disagree on what a ‘good’ tax system looks like, we can surely agree it’s not the one we have now. For one thing, it’s not even really a system, but rather a jumble of individual policies.

In fairness, this government has done more than most to correct the problem, having set out a ‘new approach to tax policy making’ with a focus on predictability, stability and simplicity (to which end it established the Office of Tax Simplification). But it’s already delayed or cancelled fuel duty rises on four separate occasions and, as Isabel reported this morning, is considering doing so again.

And you can bet that the 2015 campaign will once again focus on headline-grabbing measures (‘bring back the 10p rate’, ‘cut the 45p rate’) rather than setting out a strategy to improve the tax system as whole. But taking a holistic approach is what will actually strengthen the economy and level the playing field. And that is the standard against which manifestos — and budgets — should be judged.

Join us after Osborne delivers his Budget to discuss ‘Whatever happened to the recovery?’ Andrew Neil, Fraser Nelson and James Forsyth will discuss what the 2013 Budget means for Britain’s economic future on 20 March. Click here to book tickets.

Join us after Osborne delivers his Budget to discuss ‘Whatever happened to the recovery?’ Andrew Neil, Fraser Nelson and James Forsyth will discuss what the 2013 Budget means for Britain’s economic future on 20 March. Click here to book tickets.

Comments