Since Moscow launched its full-scale invasion of Ukraine three years ago, there has been a great deal of temptation to seize Russian sovereign assets frozen in the West. There is, after all, an urgent need and moral imperative to make the aggressor pay and use Russia’s money for Ukraine’s cause. But the reality is that unless European governments show urgent determination, Russian money is unlikely to be used to support Ukraine in its totality any time soon.

Amid the spat between Volodymyr Zelensky and Donald Trump last week, which resulted in the US stopping military aid to Ukraine, the issue of financial support for Kyiv has never been more critical. No wonder, then, that the plan to use Russian frozen assets to buy arms and time for Ukraine has resurfaced.

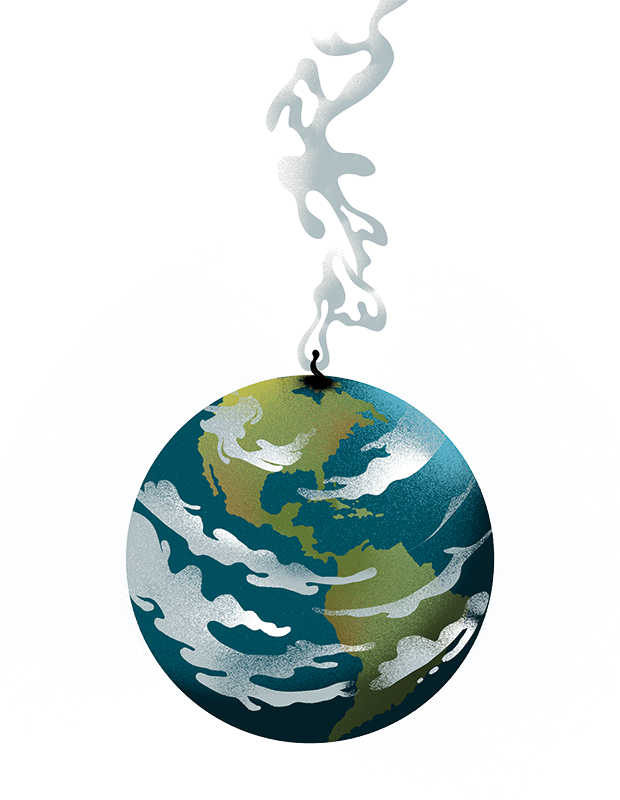

Russian assets, frozen in Europe, have a diminishing value

This idea has been floating around since the start of the war, supported by the US and the UK. It waned, however, last year thanks to the reluctance of major European countries, such as Germany, France and Belgium – where the lion’s share of these assets are held – and the European Central Bank (ECB) to go through with it.

Instead, the West settled for half-measures: the funds remain frozen, the proceeds from their investment after the start of the invasion are used to fund Ukraine, but Russia is still the legal owner of its assets. Now, though, the UK is pushing for those assets to be seized again.

The frozen sums in question total about $350 billion (£273 billion) worth of Russian financial assets, owned mainly by the Central Bank of Russia. These so-called sovereign assets are traditionally protected from seizure amid political spats and wars by international law. There were some exemptions to that rule, notably the US seizure of Iraqi holdings in 2003, but the size of these Russian assets dwarfs all previous examples combined.

The West has agreed that Russia should not get its assets back until it stops its war in Ukraine, gives up all the territory it has occupied and pays reparations. The US stance may change under the Trump administration, but the US isn’t hosting many of the frozen assets in its banks. Neither are those advocating most strongly for the seizure, including the UK.

The bulk of Russian frozen funds are held in the EU: more than half of them are held by the depositary and clearing house Euroclear in Belgium. With no precedent to follow, European governments have been reluctant to seize assets from a country they are not officially at war with. Their worries, supported by the ECB, are based on several assumptions.

Firstly, they fear that seizing Russia’s assets in this way could deter sovereign wealth funds, central banks, corporations, and private investors in the Global South from investing in European assets. A potential outflow of investment in euros would have serious consequences: rising borrowing costs, inflation, and a fall in tax revenues. On closer inspection, though, these threats may be exaggerated. Those with reason to reconsider their investment strategies would have likely done so back in February and March 2022, following the freezing of Russian assets. Nothing of the kind happened.

There are also legal concerns. Russia would inevitably challenge the seizure of its assets in court, and as long as such a case is pending, the funds will probably remain frozen and out of reach of Kyiv. Barring national courts from hearing such cases, as some US senators proposed last year, risks undermining public confidence in the legal system (though so does failing to punish an aggressor for violating international law).

Then there is a fear of Russia’s retaliation. A new law introduced in May last year allows Moscow to nationalise property belonging to nationals from countries which it believes have ‘stolen’ Russian assets abroad. However, the very few Westerners still operating in Russia are doing so at Moscow’s mercy. They can’t repatriate dividends or profits, can’t sell their companies for more than a knock-down price, and are under the constant threat of seeing their assets seized.

There is also some disagreement on how to use the funds. The UK and France have committed to leading a ‘coalition of the willing’ to help end the fighting in Ukraine and provide Kyiv with security guarantees. These Russian billions might prove handy in securing this. However, using them now to boost Ukraine’s defences would increase orders for American arms producers, undermining the France-driven effort to build a European defence industry independent of the US.

There is also the argument that these assets could be used as a bargaining chip in future talks. According to reports, Europe’s biggest powers are now weighing up a plan to threaten Moscow with the seizure of its assets if it violates a future ceasefire deal with Ukraine. The problem here is that the prospect of losing a couple of hundred billion dollars didn’t stop Moscow from launching its invasion and hasn’t forced it to stop either. It takes a leap of faith to expect that such a threat would stop the Kremlin from violating the ceasefire if it chooses to do so.

Russian assets, frozen in Europe, have a diminishing value: the longer they remain frozen, the less Russia needs them and the less hope it gives Ukraine to prevail. Seizing and using them now seems less risky for Europe than letting Russia win.

Comments