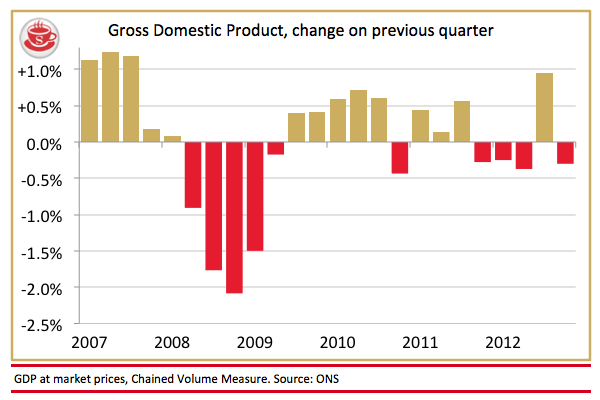

Now we know why David Cameron delivered his Europe speech on Wednesday. It’s time for bad headlines again: the GDP figures just announced show that the British economy is contracting yet again — by 0.3 per cent in the final three months of last year (see above graph).

Now, you’ll hear a lot of people tell you today that quarterly data does not matter. The ONS say this is a fallback from the Olympics, which sucked economic growth forward. And they’re right: the ONS usually revises quarterly data, often dramatically. What matters more is the long-term trend, and this is pretty appalling. It now seems inarguable that Britain is going through the worst recovery in history. Slower and longer even than the 1930s.

The petty pace of the recovery is, in some respects, deliberate. George Osborne has chosen a slow path of consolidation — cutting less over five years (3.2 per cent) than Denis Healey did in one year when the Labour government was reforming its spending (3.9 per cent) at the behest of the IMF. It’s the fiscal equivalent of tearing a plaster off slowly, so as to minimise the pain. In 2010, Osborne thought he could do this and still pull off an economic recovery by 2015. It’s now clear this means he’ll be tearing off this plaster way into the next parliament. The government boasts that it has cut the deficit by 25 per cent, but Osborne knows this is no great feat. Our fellow chronic debtors — Greece, Ireland — have made far more progress. Even Gordon Brown’s plan involved cutting the deficit by 36 per cent by now. By historic and international standards, the pace of Britain’s economic recovery is pretty pathetic.

Osborne’s strategy has been to wash it all down with artificially cheap debt, thanks to Sir Mervyn King’s magic money machine. And this is creating odd results. Normally, in such a weak economic recovery, housing would crash. But it remains pretty unaffordable. People’s mortgage repayments have plunged, especially those with 40 per cent deposits, leaving the well-off with more money to spend. This has helped keep consumer spending in reasonable shape.

But the puzzle in Osborne’s recovery is the jobs. There are now more people employed in Britain than at any point in our history, as the below graph shows.

Why? One answer is immigration: foreign-born workers account for 60 per cent of the rise in working-age employment under Osborne. Data earlier this week suggested that people are also having to accept lower salaries, and more part-time or temporary work. So the quality of jobs is going down, but the number is going up.

As Cameron will know, the biggest E for this government is not Europe but the economy. If this quarter of contraction is followed by another, then it will be a treble-dip recession. As Sir Mervin King said earlier this week, ‘living standards have been squeezed for longer than at any time in living memory.’ That’s why Cameron needs Europe to be a game-changer. The current game does seem to be one he is losing.

William Hill now have Britain odd-on (2/5) to lose its AAA credit rating before June. Those who think differently can almost treble their money. And the winner of the next election? 5-4 Labour; 11-4 Conservative ; 4-1 Lab-Lib Coalition. The odds on this coalition repeating itself are now 6-1.

P.S. George Osborne has scarpered off to Davos — I doubt many of the above graphs will feature in any presentation he’s giving. Jeremy Warner has a brilliant column in today’s Telegraph asking whether Osborne and Cameron really understand business.

Comments