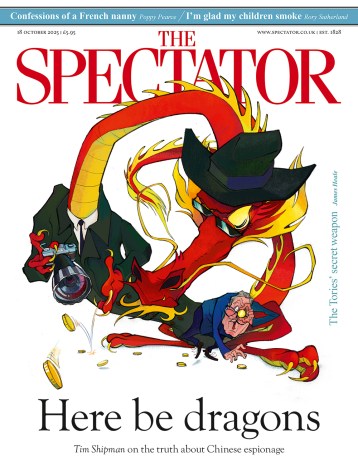

Antisemitism, Chinese spies & GB’s economic fragility

It’s been a rough week for the government: the row over the collapsed Chinese spy trial has rolled on, all while the Chancellor has been trying to lay the groundwork ahead of next month’s budget. Then, overnight, another issue has emerged as fans of the Maccabi Tel Aviv football team have been banned from attending a football game against Aston Villa next month, leading to accusations of antisemitism. Tim Shipman and Michael Simmons join James Heale to discuss the day’s developments. Tim reveals how the Chinese spy row has been picked up by American legislators, threatening to undermine the Five Eyes security alliance. Meanwhile Michael points out that the news