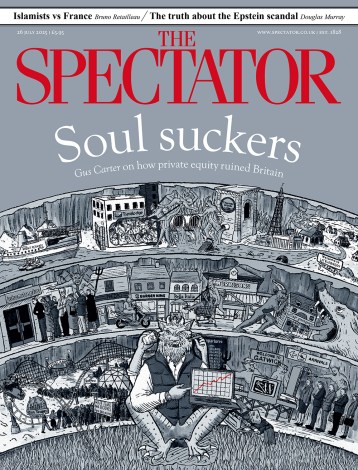

Soul suckers of private equity, Douglas Murray on Epstein & are literary sequels ‘lazy’?

First up: how private equity is ruining Britain Gus Carter writes in the magazine this week about how foreign private equity (PE) is hollowing out Britain – PE now owns everything from a Pret a Manger to a Dorset village, and even the number of children’s homes owned by PE has doubled in the last five years. This ‘gives capitalism a bad name’, he writes. Perhaps the most symbolic example is in the water industry, with water firms now squeezed for money and saddled with debt. British water firms now have a debt-to-equity ratio of 70%, compared to just 4% in 1991. Britain’s desperation for foreign money has, quite literally,