Labour goes on the Farage offensive

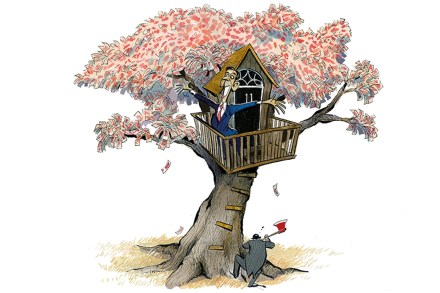

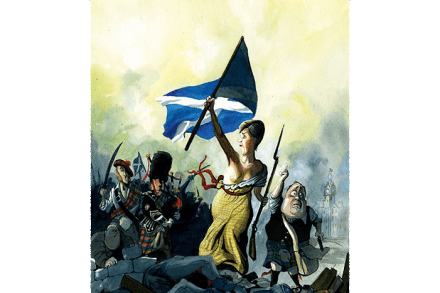

As James Heale writes online for the Spectator today, ‘two issues continue to plague the government’: how best to attack Nigel Farage. and how to frame an incrementalist approach to policy ‘when the national mood favours radical change’. Nick Thomas-Symonds, the Cabinet Office minister responsible for UK-EU relations, attempted to tackle both today as he came to the Spectator to set out Labour’s Europe strategy. Labour are pursuing ‘pragmatic alignment’ – what they argue is greater co-operation when beneficial to the British interest. But what does this mean? James joins Michael Simmons on the podcast to unpack the speech. And, on a day when Reform have claimed another defector (this