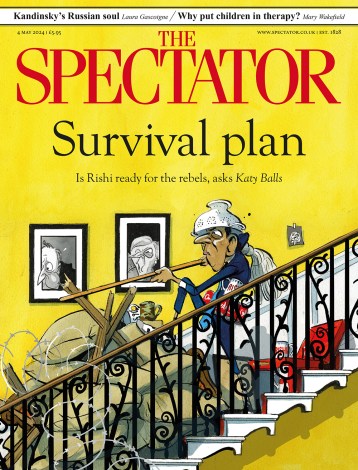

We will never hear the end of Rishi’s tax cut

The bean-counters squared up in the Commons today. Chancellor Rishi Sunak delivered a terse spring statement which contained three major bombshells. And he was answered by Labour’s shadow chancellor, Rachel Reeves, who unfurled a few surprises of her own. Sunak gave an upbeat assessment of Britain’s economy but warned that our growth is about to be clobbered by Putin’s Ukraine adventure. Sunak expects inflation to peak at 7 per cent, or more. That’s effectively a huge pay-cut for every citizen, not just those in work, and it may nudge us closer to a recession. But he kept the R-word to himself. Sunak seems to enjoy being liked and he was