The great holiday Covid test rip-off

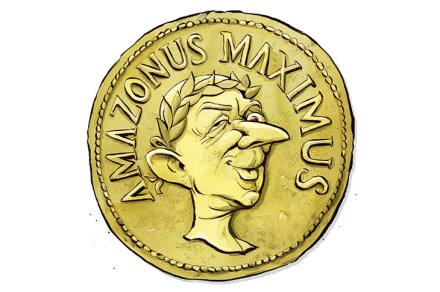

I holidayed in Malta last month with my partner, having chosen it because it was on the ‘green list’. Foolishly, I assumed this would mean we could waltz back to the UK without any hassle. I was wrong. We needed a test before departing Malta. Within a few minutes of looking on the Malta airport website, I found a provider, headed to their test centre, and €30 later, was given the all clear. But that wasn’t all. To complete my pre-flight passenger form, I needed a ‘Day 2’ test for when I was home. For this, the UK government has a website pointing holidaymakers towards a slew of private firms