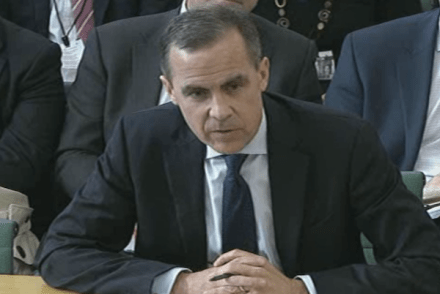

Why Britain lost its AAA rating

Even the pessimistic analysts had given Britain until September to lose its AAA rating. That it has happened now, before the Budget, shows just how fast things are moving. Moody’s has tonight downgraded Britan from AAA to AA1 and has also told us why. Don’t expect economic hell to break loose as a result: these ratings tend to follow, rather than lead, the markets. But this is politically devastating for George Osborne, given that he has asked us to judge him by the preservation of this rating (and made it a manifesto pledge). So what went wrong? 1. The markets now doubt that Osborne has a credible debt strategy. The