More advance snippets from the Budget

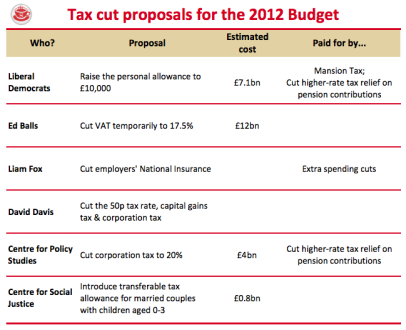

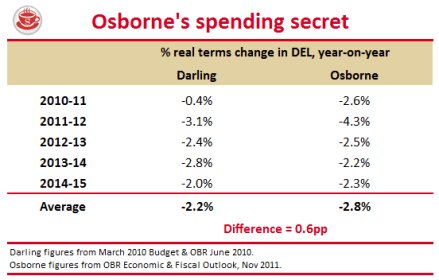

The big Budget news tonight is that the personal allowance will rise to £9,205. This is a larger increase than expected and, intriguingly, will be paid for — in part — by a couple of billion more of spending cuts. So, the Lib Dems see considerable progress on their main budget priority, raising the income tax threshold to £10,000, but this will be partially funded by something Tory MPs have been calling for, more spending cuts. It also appears that the coalition will further increase the pace of its corporation tax cuts as well as introducing a new higher rate of stamp duty for £2 million plus houses. There’ll also