The debt Gordon Brown has saddled his country with deserves to be a top political as well as financial issue, as The Times powerfully argues in a leader today. Gordon Brown has over the last week been on a mission to airbrush Northern Rock out of the national accounts. He has claimed repeatedly—and mendaciously—that he’s taken debt as a share of GDP from 44% to 37%.

The Times in its leader today gets it precisely right. Not only does it use the correct net debt figure – 43.3% in August – but it goes on to lambaste Brown.

“This parlous financial position is a direct political legacy. A government of genuine prudence might have put money in the bank at the top of the cycle to pay for the bills at the bottom. But it would then have been unable to argue that Conservative plans to cut taxes would require cuts in public services.”

But what really grabbed my attention was the sign-off.

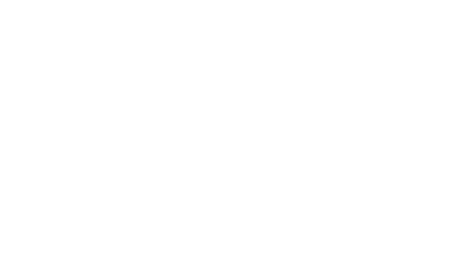

Precisely so: it is the combination of government and household debt that has left Britain in such a perilous state. Brown gets away with it because there is no metric that puts the two together. No warning light to flash red. This allows Brown to argue that UK debt is low by international standards. We’re at 49% on a Maastricht basis compared to 104% for Italy and 86% for Japan But, crucially, these countries have lower household debt – 69% of net income in Italy, 130% in Japan but an eye-watering 177% for Britain.“In the year ahead, debt – national, institutional and personal – will be the battleground.”

If CoffeeHousers will indulge me, the below graph of household debt in the G7 countries since 1985 tells the story. Observe how little the Lawson boom depended on debt. It demonstrates a point first made by Michael Saunders of Citibank – that UK household debt is not only the highest in the G7 but the highest any G7 country has ever known. We simply must put the whole debt picture together. Only then will we realise just the full nature of the mess Brown has got us into.

(PS – p8 headline in The Times: “Brown says banks were irresponsible”)

Comments