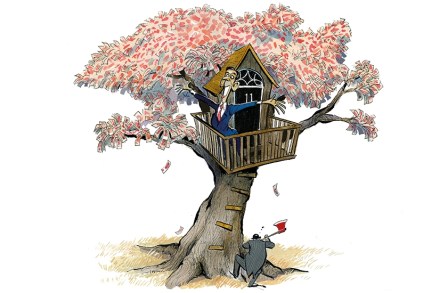

Ed Miliband can’t ban fracking forever

He wasn’t able to announce the £300 off household energy bills that was promised during the election campaign. Nor could he unveil any massive new solar farms or wind turbines. Still, the Energy and Climate Change Secretary Ed Miliband did have one message to cheer the party faithful in his conference speech today: he is going to ban shale oil and gas for all time. ‘Let’s ban fracking and send the frackers packing,’ he thundered. But can Miliband really do that and outlaw fracking forever? Only a fool would pretend that he can. Right now, there is a moratorium on extracting shale oil and gas in the UK, which could,