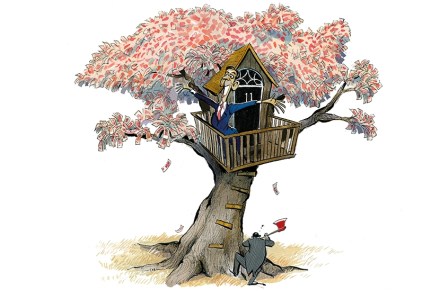

In defence of ‘fat cat’ chief executives

Are chief executives overpaid? The High Pay Centre thinks so. Every January, it releases data showing the huge inequality between top UK CEOs and average workers. The results are startling: ‘Bosses of Britain’s biggest companies will have made more money in 2024 by lunchtime on Thursday than the typical worker will all year,’ according to the BBC, which wrote up the story showing that top bosses’ average reward amounts to £3.81 million a year. But is this disparity with the £34,963 annual median wage for full-time workers really a surprise? The truth is that this pay gap is an obvious feature of a free market where top pay in business