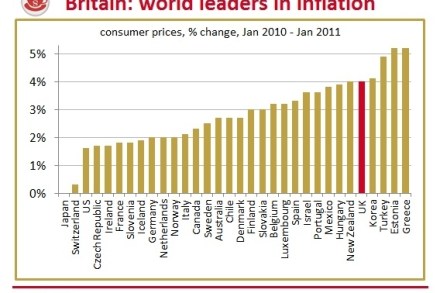

Cable’s punditry could come unstuck

“It’s not imminent. But you can see this happening.” So sayeth Vince Cable about the prospect of another global financial crisis, in interview with the New Statesman today. To be fair, you can see his point: there is a pervasive sense that the contradictions of the banking sector still haven’t been fixed, and — as I have written recently — our economy, and economies worldwide, are still afflicted by debt of all varieties. But that’s not going to calm those Tories who regard Cable as a combustive liability. In the weeks since the Lib Dems’ annihilation at the polls, the Business Secretary has increasingly reverted to his pre-coalition form: a