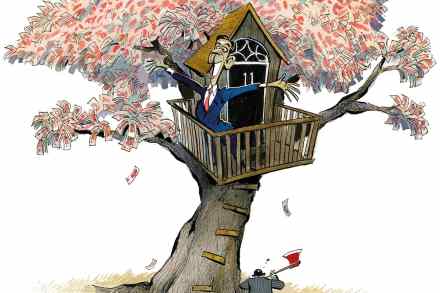

Will someone wake up the Bank of England?

It is called managing expectations: the steady drip of forecasts and scenarios designed to prepare us for bad news, so that when that news does finally arrive it doesn’t seem nearly as bad as it would otherwise have done. So is that what the Bank of England is up to with its deputy governor, Ben Broadbent, telling us that inflation next April could ‘comfortably exceed’ 5 per cent? It is reminiscent of the moment in July when the Bank’s departing chief economist, Andy Haldane, dropped in the suggestion that inflation by the end of 2021 could be closer to four percent than three percent. The MPC is behaving like a Chancellor