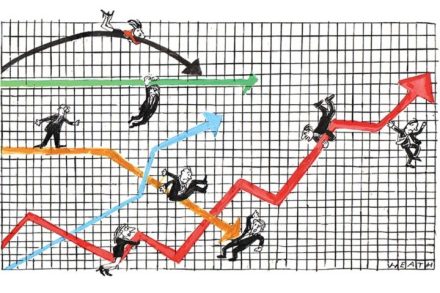

Rachel Reeves has shattered economic confidence in Britain

A few journalists have pointed it out. So have some Conservative and Reform MPs, think tanks and one or two of the City banks. Now, it is official: the Bank of England (BofE) has warned that Chancellor Rachel Reeves’s October Budget has caused Britain’s economy to stagnate. The real question now is when will the pressure on Reeves to reverse some of the measures in her catastrophically misjudged Budget become so intense that she has to give in? For a central Bank, the language was about as harsh as it gets. In its latest assessment of the economy, while keeping interest rates on hold, the BoE argued that businesses were