Panic over? Perhaps not…

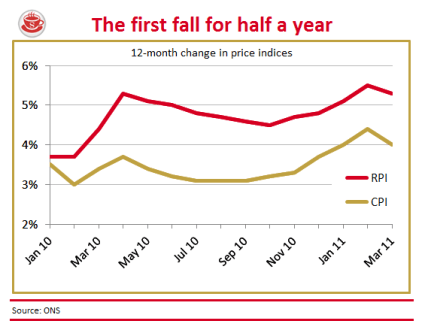

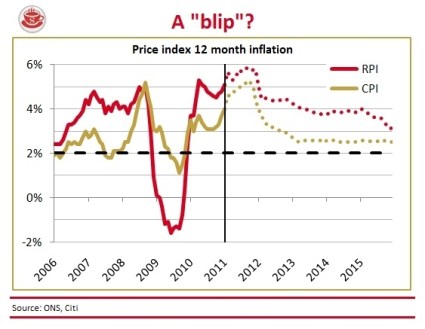

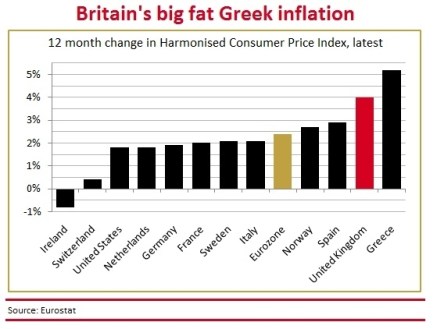

Is the inflation panic over? After rising for five consecutive months, CPI inflation went down by a 0.4 percentage points in March, to 4.0 per cent, taking the City by surprise. RPI inflation also went down, by 0.2 percentage points. The numbercrunchers at the Office for National Statistics put it down, largely, to a fall in food and drink prices. The cost of fruit is 2.7 per cent down on last March. The cost of bread and cereals, 2.6 per cent. Yet we shouldn’t get ahead of ourselves. While this will certainly reduce the short-term pressure on the Bank to increase rates — as well as on the nation’s pocketbooks