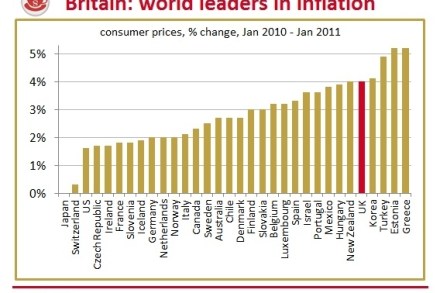

Spiralling inflation continues to squeeze some more than others

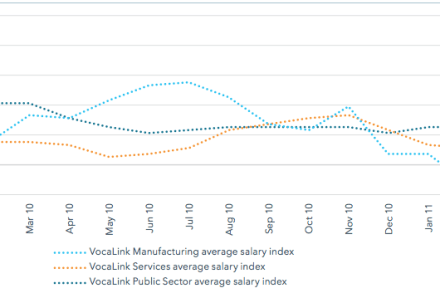

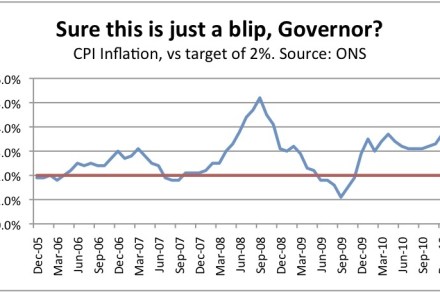

The February inflation figures spell more bad news for living standards in the UK. With average weekly earnings growth standing at just 2.2 per cent, millions of workers continue to get poorer in real terms. However, differences in the make-up of typical “shopping baskets” mean that the spending implications of inflation vary by income group. Since 2007, inflation has been driven primarily by increases in food and fuel prices. Given that such staples account for a larger share of weekly expenditure among lower income households than among higher income ones, the impact is felt more acutely in the lower half of the income distribution. The below chart details the impact